B.Tech (CSE)

HSMC - 02

Economics for Engineers

MCQ's and fill in the blanks Unit - I Unit - II Unit - III Unit - IV Unit - V Unit- VI

Question Bank - Unit - I Unit - II Unit - III Unit - IV Unit - V Unit- VI

Previous Year Questions

Introduction

"Economics is the study of individual decision-making units, such as consumers and firms, and how they allocate resources and interact in markets." - This definition emphasizes the micro-level analysis of economic agents and their interactions within markets.

Role of Economics in Engineering

Economics plays a vital role in engineering by helping engineers make cost-effective, efficient, and sustainable decisions in various projects. Below are some key ways in which economics influences engineering:

-

Cost-Benefit Analysis (CBA) – Engineers use economic principles to evaluate the feasibility of projects by comparing costs and expected benefits, ensuring optimal resource utilization.

-

Resource Allocation – Economics helps engineers allocate limited resources efficiently, such as labor, materials, and capital, to maximize productivity and minimize waste.

-

Project Budgeting and Cost Estimation – Economic principles guide engineers in estimating costs, preparing budgets, and controlling expenditures to keep projects financially viable.

-

Market Demand and Feasibility Studies – Engineers assess economic demand before designing or manufacturing products to ensure their commercial success.

-

Optimization of Production Processes – Economic analysis helps engineers design systems and processes that minimize costs while maximizing efficiency and output.

-

Risk Assessment and Management – Economic risk analysis aids engineers in identifying potential financial risks, uncertainties, and mitigation strategies in projects.

-

Sustainability and Environmental Economics – Engineers apply economic principles to develop eco-friendly solutions that balance environmental impact with economic viability.

-

Engineering Management and Decision-Making – Economic knowledge is crucial in managing engineering firms, setting prices, and making strategic business decisions.

-

Infrastructure Development – Economic considerations guide engineers in designing public infrastructure projects such as roads, bridges, and utilities, ensuring cost-effectiveness and long-term sustainability.

-

Innovation and Technology Development – Economics influences research and development (R&D) investments, helping engineers innovate while considering market trends and cost constraints.

In summary, economics enables engineers to make informed decisions that lead to efficient, cost-effective, and sustainable engineering solutions.

Relationship between science and engineering: - The relationship

between science and engineering is closely interconnected and symbiotic. Here

are the key points illustrating this relationship:

1. Foundational Knowledge:

- Science: Provides fundamental principles and theories that explain natural phenomena.

- Engineering: Applies these scientific principles to create practical solutions and innovations.

2. Research and Development:

- Science: Focuses on discovering new knowledge and understanding the natural world.

- Engineering: Uses scientific research to develop new technologies, materials, and processes.

3. Problem-Solving:-

- Science: Identifies and explores new problems and questions about how the world works.

- Engineering: Solves specific problems by designing and implementing effective solutions based on scientific knowledge.

4. Methodology:

- Science: Utilizes the scientific method to hypothesize, experiment, observe, and conclude.

- Engineering: Employs the engineering design process, which includes defining problems, brainstorming, prototyping, testing, and iterating.

5. Innovation and Progress:

- Science: Drives progress through discoveries that expand our understanding of the universe.

- Engineering: Translates scientific discoveries into new technologies and systems that improve quality of life.

6. Interdisciplinary Collaboration:

- Science: Often requires engineering expertise to develop experimental apparatus and technologies.

- Engineering: Relies on scientific insights to push the boundaries of what is technically feasible.

7. Education and Training:

- Science: Educates individuals about the natural laws and theories that govern the universe.

- Engineering: Trains individuals to apply this knowledge practically, often involving specialized technical skills.

8. Economic and Social Impact:-

- Science: Enhances our understanding and can lead to societal shifts through new knowledge.

- Engineering: Directly impacts society by creating products, infrastructure, and technologies that shape modern life.

9. Iterative Feedback Loop:

- Science: New scientific discoveries often lead to new engineering applications.

- Engineering: Engineering innovations can open up new fields of scientific inquiry.

Science and engineering are complementary disciplines.

Science seeks to understand the underlying principles of the universe, while

engineering applies that understanding to solve practical problems and create

new technologies.

Relationship Between Science, Engineering, Technology, and Economic Development:- Science,

engineering, technology, and economic development are closely interconnected, with each playing a critical role in driving progress and enhancing the quality of life. Here’s how they relate to each other:

1. Science:

Definition: The systematic study of the natural world through observation and experimentation, leading to the development of theories and knowledge.

Role in Economic Development: Scientific discoveries and advancements provide the foundational knowledge necessary for technological innovations. For example, breakthroughs in physics, chemistry, and biology have led to new materials, medical treatments, and energy solutions, all of which contribute to economic growth.

2. Engineering:

Definition:

The application of scientific principles to design, build, and maintain structures, machines, and systems.

Role in Economic

Development: Engineers translate scientific knowledge into practical applications, creating infrastructure, technology, and products that drive economic activities. Engineering advancements improve efficiency, productivity, and quality of life, from building transportation networks to developing advanced manufacturing processes.

3. Technology:

Definition:

The application of scientific knowledge for practical purposes, especially in industry. It encompasses tools, machines, techniques, and systems that solve problems and enhance human capabilities.

Role in Economic

Development: Technological innovation is a key driver of economic growth. It leads to new industries, improves existing ones, increases productivity, and creates jobs. For instance, the advent of information technology has revolutionized business practices, communication, and access to information, leading to significant economic benefits.

4. Economic Development:

Definition: The process by which the economic well-being and quality of life of a nation, region, or community are improved. It typically involves growth in income, education, infrastructure, and employment opportunities.

Role of Science, Engineering, and Technology: Economic development relies on the continuous advancement of science, engineering, and technology. Investments in these areas lead to innovations that enhance productivity, create new markets, and improve health and education. This, in turn, attracts

further investment and fosters a cycle of growth and development.

Interrelationships:

Innovation Cycle:

Scientific research leads to new discoveries, which engineers use to develop new technologies. These technologies are then applied in various industries, driving economic growth. For example, the development of the internet (technology) was based on scientific research in computer science and engineering, leading to new businesses and industries (economic development).

Productivity and Efficiency: Advances in engineering and technology improve the efficiency and productivity of various economic sectors. Automated manufacturing processes, advanced agricultural techniques, and efficient transportation systems are all outcomes of engineering innovations that boost economic output.

Quality of Life: Technological advancements in healthcare, education, and communication directly improve the quality of life, leading to a more skilled and healthier workforce, which in turn supports economic development.

Global Competitiveness: Nations that invest in science, engineering, and technology are better positioned to compete globally. They can produce high-value goods and services, attract investment, and maintain economic stability and growth.

Science provides the knowledge, engineering applies this knowledge, technology delivers practical tools and solutions, and together they drive economic development by improving productivity, creating new industries, and enhancing the quality of life. This synergy fosters a sustainable and dynamic economy.

1. Future Value Calculation

Problem:

You invest $2,000 in an account that offers an annual interest rate of 5%, compounded annually. What will be the future value of this investment after 10 years?

Solution:

- Given: , ,

- Formula:

- Calculation:

- FV=2000×(1+0.05)10=2000×1.628895=3257.79

Answer: The future value of the investment after 10 years is approximately $3,257.79.

2. Present Value Calculation

Problem:

You are promised $5,000 to be received in 7 years. If the discount rate is 8% per year, what is the present value of this future amount?

Solution:

- Given: ,

- Formula:

- Calculation:

Answer: The present value of $5,000 to be received in 7 years is approximately $2,917.97.

3. Interest Rate Calculation

Problem:

You invested $1,000, and it grew to $1,500 in 6 years. What is the annual interest rate?

Solution:

- Given: , ,

- Formula:

Rearrange to solve for : - Calculation:

Answer: The annual interest rate is approximately 6.97%.

Capital Budgeting :- Capital Budgeting decision is considered most important and most critical decision for finance manager. It involves decisions related to long-term investments of capital nature. The returns from such investments are scattered over a number of years. Since it requires huge amount of funds, it is considered irreversible.

Some examples of capital budgeting decisions are Purchase of new plant and machinery, replacement of old plant and machinery, expansion and diversification decision, research and development projects etc.

According to Charles T. Horngren:

“Capital Budgeting is long-term planning for making and financing proposed capital outlays.”

According to L.J. Gitman:

“Capital Budgeting refers to the total process of generating, evaluating, selecting and following up on capital expenditure alternatives.”

The process of Capital Budgeting:-

The process of capital budgeting involves following steps

- Project Generation: In the first step, projects for investments are identified. This projects may be undertaken to increase revenue or to reducing cost. for this, proposals for expanding production capacity, proposals for replacement of plant etc. could be undertaken.

- Project Evaluation: In this step, costs and benefits from such projects are evaluated. Projects are judged on the basis of profitability and returns it offers to the firm.

- Project Selection: The projects generated and evaluated are then screened at various levels of management. After screening, the top management may decide whether to select or reject the proposal.

- Project Execution: A project is executed after final selection is made by the management. Required funds are allocated to execute the project.

- Follow-up: Executed projects are then followed-up. Actual performance of the project is compared with the expected performance and deviations are found out. With the help of which future decisions are taken.

Capital Budgeting:- The decision of investing funds in the long term assets is known as Capital Budgeting. Thus, Capital Budgeting is the process of selecting the asset or an investment proposal that will yield returns over a long period.

The first step involved in Capital Budgeting is to select the asset, whether existing or new on the basis of benefits that will be derived from it in the future.

The next step is to analyze the proposal’s uncertainty and risk involved in it. Since the benefits are to be accrued in the future, the uncertainty is high with respect to its returns. Finally, the minimum rate of return is to be set against which the performance of the long-term project can be evaluated.

Working Capital Management:- The working capital management deals with the management of current assets that are highly liquid in nature.

The investment decision in short-term assets is crucial for an organization as a short term survival is necessary for the long-term success. Through working capital management, a firm tries to maintain a trade-off between the profitability and the liquidity.

In case a firm has an inadequate working capital i.e. less funds invested in the short term assets, then the firm may not be able to pay off its current liabilities and may result in bankruptcy. Or in case the firm has more current assets than required, it can have an adverse effect on the profitability of the firm.

Thus, a firm must have an optimum working capital that is necessary for the smooth functioning of its day to day operations.

Techniques of Capital Budgeting:-

Capital budgeting techniques are the methods to evaluate an investment proposal in order to help the company decide upon the desirability of such a proposal. These techniques are categorized into two heads : traditional methods and discounted cash flow methods.

Traditional Methods:- Traditional methods determine the desirability of an investment project based on its useful life and expected returns. Furthermore, these methods do not take into account the concept of time value of money.

Pay Back Period Method:- Payback period refers to the number of years it takes to recover the initial cost of an investment. Therefore, it is a measure of liquidity for a firm. Thus, if an entity has liquidity issues, in such a case, shorter a project’s payback period, better it is for the firm.

Therefore,

Payback period = Full years until recovery + (unrecovered cost at the beginning of the last year)/

Cash flow during the last year:- Here, full years until recovery is nothing but the payback that occurs when cumulative net cash flow equals to zero. Cumulative net cash flow is the running total of cash flows at the end of each time period.

Average Rate of Return Method (ARR):- Under ARR method, the profitability of an investment proposal can be determined by dividing average income after taxes by average investment, which is average book value after depreciation.

Thus, ARR = Average Net Income After Taxes/Average Investment x 100

Where, Average Income After Taxes = Total Income After Taxes/Total Number of Years

Average Investment = Total Investment/2

Based on this method, a company can select those projects that have ARR higher than the minimum rate established by the company. And, it can reject the projects having ARR less than the expected rate of return.

Module

-3

Demand: In

economics, demand refers to the desire, willingness, and ability of consumers

to purchase a good or service at a particular price over a certain period of

time. It's a fundamental concept that lies at the core of market economies,

driving the production and allocation of resources. Demand not only reflects

the preferences of consumers but also their financial capacity to fulfill those

preferences.

Components

of Demand

a) Desire

for a Good or Service: At the most basic level, demand

begins with the desire for a product or service. However, desire alone doesn't

constitute effective demand unless it is backed by the willingness and ability

to pay.

b) Willingness

to Pay: This refers to the consumer’s intent to actually

spend money on a good or service, as opposed to merely wanting it. It involves

a decision-making process influenced by individual preferences, expectations,

and budget constraints.

c) Ability

to Pay: Even if consumers want and are willing to purchase a

product, they need the financial resources to do so. This aspect of demand

takes into account income levels, access to credit, and other financial

considerations.

d) Specific

Time Period: Demand is always measured over a specific

period of time. For example, the demand for ice cream is typically higher

during summer months than in winter. Economists usually specify the time frame

to assess and compare demand trends accurately.

The

Law of Demand:- The law of demand is a fundamental

principle in economics that states that, ceteris paribus (all else being

equal), the quantity demanded of a good or service falls as its price rises,

and vice versa. In other words, there is an inverse relationship between price

and quantity demanded.

This

relationship is graphically represented by the demand curve, which slopes

downward from left to right. The slope reflects that when prices decrease,

consumers are more likely to purchase more of the good or service, increasing

the quantity demanded.

For

example, Suppose

in any economy a commodity price was initially Rs 500/article which rises

subsequently as P2 – Rs 800 and P1 – Rs

1000 due to various price-affecting factors and the rise in price ultimately

led to the drop in demand that was initially Q3 – 1000 articles to Q2 – 700 articles and Q3 – 500 articles as

shown in the diagram.

The

diagram shows that with an increase in the prices of a commodity from P3 to

P2, the demand for that product decreases from Q3 to

Q2 and vice versa.

The

law of demand assumes that other factors (such as consumer income, preferences,

and the prices of related goods) remain constant. In reality, these factors

often change, leading to shifts in the demand curve.

The Demand Curve:- The

demand curve is a graphical representation of the relationship between the

price of a good and the quantity demanded. It is usually downward-sloping

because, under normal circumstances, consumers tend to buy more of a product

when its price falls and less when its price rises.

· Movement

Along the Demand Curve: A movement along the curve occurs

when the price of the good changes, leading to a change in the quantity

demanded. This is called a "change in quantity demanded."

· Shifts

in the Demand Curve: A shift in the demand curve happens when

factors other than the price of the good change. This could be due to changes

in consumer income, tastes, or the prices of related goods. A shift to the

right indicates an increase in demand, while a shift to the left indicates a

decrease.

Types of Demand

1) Individual

Demand: This refers to the demand for a product or service by

a single consumer. It reflects how much of a good an individual is willing and

able to purchase at different prices.

2) Market

Demand: Market demand is the sum of all individual demands

for a product or service. It represents the total quantity demanded by all

consumers in a particular market at various price levels.

3) Derived

Demand: Derived demand occurs when the demand for one product

is driven by the demand for another product. For example, the demand for steel

is derived from the demand for cars and construction projects that require

steel as an input.

4) Joint

Demand: This happens when two or more products are demanded

together because they complement each other. For example, printers and ink

cartridges are in joint demand; an increase in the demand for printers usually

leads to an increase in the demand for ink cartridges.

5) Composite

Demand: Composite demand occurs when a good is demanded for

multiple purposes. For instance, crude oil is used to produce gasoline,

plastics, and other products. Changes in demand for any of these products can

influence the total demand for crude oil.

Factors

Affecting Demand:- Several factors influence demand in both

direct and indirect ways. Understanding these factors helps explain shifts in

the demand curve and variations in consumer behavior.

1.

Price of the Good or Service: The price is the primary

factor affecting demand. According to the law of demand, an increase in the

price of a good typically leads to a decrease in quantity demanded, while a

decrease in price leads to an increase in quantity demanded.

2.

Income Levels: When consumers experience an increase in

income, they are generally able to purchase more goods and services, increasing

demand. Conversely, a reduction in income can reduce demand. Income effects

vary for different types of goods:

· Normal

Goods: Goods for which demand increases as income rises. For

example, as incomes grow, people tend to buy more clothing, electronics, and

dining experiences.

· Inferior

Goods: Goods for which demand decreases as income rises.

These are often lower-quality substitutes that people buy less of when they can

afford better alternatives.

3.

Prices of Related Goods:

· Substitute

Goods: These are goods that can replace each other. For instance, if the price

of tea rises, consumers may switch to coffee, increasing the demand for coffee.

· Complementary

Goods: These are goods that are used together. For example, an increase in the

price of cars may reduce the demand for gasoline because fewer cars will be

purchased or used.

4.

Consumer Preferences and Tastes: Changes in consumer

preferences, driven by trends, culture, marketing, or personal experiences, can

significantly influence demand. For instance, as people become more

health-conscious, the demand for organic food has increased.

5.

Expectations of Future Prices: If consumers expect

prices to rise in the future, they may increase current demand to avoid paying

higher prices later. Conversely, if they expect prices to fall, they may delay

purchases, reducing current demand.

6.

Population Size and Demographics: A larger population

leads to higher demand for goods and services, all else being equal.

Additionally, the composition of the population, such as age distribution or

income levels, can influence demand for specific products.

7.

Government Policies: Taxes, subsidies, and regulations can

impact demand. For example, a tax on cigarettes might reduce demand, while a

subsidy on electric vehicles could increase demand.

Elasticity

of Demand:- Elasticity of demand helps us to estimate

the level of change in demand with respect to a change in any of the

determinants of demand. The concept of elasticity of demand helps the firm or manager

in decision making with respect to pricing, promotion and production polices.

It has a very great importance in economic theory ss well for formulation of

suitable economic policy.

Elasticity

is the measure of the degree of responsiveness of change in one variable to the

degree of responsiveness change in another variable.

The

concept of elasticity of demand therefore refers to the degree of

responsiveness of quantity demanded of a good to the change in its price,

consumers income and price of related goods.

Types

of Elasticity:-

1.

Price Elasticity of Demand: Price

elasticity of demand shows the degree of responsiveness of quantity demanded of

a good to the change in its price, other factors such as income, prices of

related commodities that determines demand for the commodity which are held

constant. In other words, price elasticity of demand is defined as the ratio of

the percentage change in quantity demanded of a commodity to a percentage

change in price of the commodity.

Thus,

The demand curve for most of the

commodities, is downward sloping due to the inverse relationship between

quantity demanded and price of the commodity, the value of the price

elasticity of demand will always be

negative. While interpreting the price elasticity of demand the negative sign

is ignored or omitted.

This is because we are interested in

measuring the magnitude of responsiveness of quantity demanded of a good to

changes in its prices.

2.

Income Elasticity of Demand: As

we have discussed earlier the factor which determines elasticity of demand for

a commodity. The consumer’s income is one of the important determinants of

demand for a commodity. The demand for a commodity and consumer’s income is

directly related to each other, unlike price-demand relationship.

Income elasticity of demand shows the

degree of responsiveness of quantity demanded of a commodity to a small change

in the income of a consumer. In other words, the degree of

responsiveness of quantity demanded to a

change in income is measured by dividing the proportionate change in quantity demanded

of a commodity by the proportionate change in the income of a consumer.

3.

Cross-Price Elasticity of Demand: Sometimes

we find two goods are inter-related to each other either they are substitute

goods or commentary goods. Cross elasticity of demand measures the degree of

responsiveness of demand for one good in responsive to the change in the price

of another good.

Classification of goods based on value of

cross elasticity of demand:

a) Substitution:

If the value of elasticity between two goods are positive the goods are said to

be substitute to each other. For example, Tea and coffee, if the price of tea

increases the demand for coffee increases.

b) Complementary:

if the value of elasticity between two goods are negative the goods are said to

be complementary. For example, car and petrol, if the price of petrol increases

the demand for car decreases.

c) Unrelated:

if the value of elasticity between two goods are zero then the goods are said

to be unrelated to each other. For example, table and car, if the price of

table increases there is no change in the demand for car.

Demand

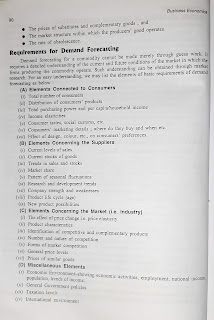

Forecasting: Demand forecasting means estimation of

demand for the product for a future period. Demand forecasting enables an organization

to take various decisions in business, such as planning about production

process, purchasing of raw materials, managing funds in the business, and

determining the price of the commodity. A business organization can forecast

demand for his product by making own estimations called guess or by taking the help

of specialized consultants or market research agencies.

Methods:

-

Module

IV

MEANING OF PRODUCTION: The

term ‘production’ is very important and broader concept in economics. To meet the daily demand of a

consumer production is essential part. Production is a process by which various

inputs are combined and transformed into output of goods and services, for

which there is a demand in the market. In other words, Production is a process

of combining various material inputs and immaterial inputs in order to make

something for consumption. The essences of production are the creation of

utilities and the transformation of inputs or resources into output. Inputs are

the resources used in the production of goods and services the important

resources or input in production are land, labour, capital, and entrepreneur.

Production process creates economic well-being into the nation. Thus,

production is a process which creates utility and value in exchange.

The theory of production

function is concern with the problem in the production process in a certain

level of output. It analyses the relation between cost and output and help the

firm to determine its profit. All firms that aims at maximising their profit must

make their decision regarding production on the bases of the following three

decision:

a)

How much output to produce and supply in

the market?

b)

How to produce the product, i.e. which

technique of production or combination of production to used have to be

decided?

c)

How much quantity of input is demanded to

produce the output of the product?

Thus, the above three

decisions are interrelated and have to be taken by the firm during the

production process.

PRODUCTION FUNCTION:-

In

economics, a production function is the functional relationship between

physical output of a production process to physical inputs or factors of

production. In other words, production function denotes an efficient

combination of input and output. The factors which are used in the production

of goods and services are also called as agents of production. Production

function of a business firm is determined by the state of technology. More specifically,

production function shows the maximum volume of physical output available from

a given set of inputs, or the minimum set of inputs necessary to produce any

given level of output.

“A production function

refers to the functional relationship, under the given technology, between

physical rates of input and output of firm, per unit of time”.

Mathematically,

production

function can be express as: Q = f (N, L, K, E, T, etc.)

I. The production

function can be broadly categorised into two based on the time period i.e.

A)

Short run production function: The short run is defined

as the period during which at least one of the input is fixed. According to the

following short-run production function, labour is the only variable factor

input while the rest of the inputs are regarded as fixed. In other words, the

short run is a period in which the firm can adjust production by changing

variable factors such as materials and labour but cannot change fixed factors

such as land, capital, etc. Thus, in short-run some factors are fixed and some

are variable.

B)

Long run production function: The long run production function

is defined as the period of time in which all factors of production are

variable. In the long run there is no distinction between the fixed or variable

factor as all factors in the long run are variable.

II. The production

function can also be classified on the basis of factor proportion i.e.

a)

Fixed proportion production function and

b)

Variable proportion production function.

A.

Fixed proportion production function: The fixed proportion production

function, also known as a Leontief Production Function which implies the fixed

factors of production function such as land, labour , raw materials are used to

produce a fixed quantity of an output and these factors of production function cannot

be substituted for the other factors. In other words, in such factors of

production function fixed quantity of inputs is used to produce the fixed

quantity of output. All factors of production are fixed and cannot be

substituted for one another.

The

concept of fixed proportion production function can be further explained with

the help of a Diagram 5.1 as shown below:

B.

Variable proportion production function: The variable proportion

production function supposes that the ratio in which the factors of production

such as labour and capital are used in a variable proportion. Also, the

different combinations of factors can be used to produce the given quantity,

thus, one factor can be substituted for the other factor. In the case of

variable proportion production function, the technical Coefficient of production

function is variable, i.e. the important quantity of output can be achieved

through the combination of different quantities of factors of production, such

as these factors can be varied by substituting one factors to the other/

factors in its place.

The

concept of variable proportion production function can be further explained

from an isoquant curve, as shown in the Diagram 5.2 below:

In

the above diagram, the isoquant curves show that the different combinations of

factors of technical substitution shows that it can be employed to get the

required amount of output in the production process. Thus, for the production

of a given level of product, the input factors can be substituted from another

factor input.

LAW

OF VARIABLE PROPORTION:- The law of variable proportion is a short run

production function theory. This law plays a very important role in the economic

theory, which examines the production function with which one variable factor

keeping the other factors input fixed. This law is explained by the classical

economists to explain the behaviour of agricultural output. In other words, it

examines the behaviour of the production in the short-run when the quantity of one

factor is varied, keeping the quantity of another factor’s constant. Thus, the

law of variable proportion is the new name for the famous theory “The Law of

Diminishing Marginal Returns” of classical economist.

Alfred

Marshall, had discussed the law in relation to agriculture, according to him,

“an increase in the capital and labour applied in the cultivation of land

causes in general a less than proportionate increase in the amount of product

raised unless it happens to coincide with an improvement in the art of

agriculture”.

Marginal

productivity of labour in agriculture is zero.

Assumptions:

The law of variable proportion is based on the following assumptions:

a) The

state of technology is assumed to be given and constant.

b) There

must be some inputs whose quantity must be kept as fixed or constant. Such

input factors are called fixed factors.

c) All

units of variable factors inputs are homogenous.

d) The

law is based upon the possibility of varying the proportions in which the

various factors can be combined to produce the level of output. Let us assume

the labour is the variable factor in our explanation.

Change

in output due to increase in variable factors can be explain with the table

given below:

Very informative blog

ReplyDeleteVery informative....👍

ReplyDeleteHelpfull.....

ReplyDeleteThe perspective on this topic is truly enlightening

ReplyDeleteEk number baba ek number🤙

ReplyDeleteGreat insights on economic trends. The analysis is well-researched.

ReplyDeleteGood

ReplyDeleteAs a student living in a busy apartment complex, finding peace and quiet for studying can be a real challenge. These noise-cancelling headphones have been a game-changer. The difference they make is immediately noticeable – the constant hum of traffic and chatter from neighbors practically disappears. What impressed me most was the effectiveness across different frequency ranges; it wasn't just low rumbles that were blocked out, but also higher-pitched sounds. The audio quality for music is also excellent, with a clear and balanced sound profile. They are comfortable to wear for extended study sessions, thanks to the plush earcups and adjustable headband. While the price is a bit of an investment, the improved focus and listening experience make it well worth it for anyone needing a quiet environment. Highly recommended!

ReplyDeleteFor someone like me, coming from a technical background, these notes provide a solid introduction to the economic principles that are relevant to engineering. They're well-structured and cover the key topics. While a few additions could make it even more engaging, it's a good resource for understanding the crucial link between engineering and economics. It definitely helped me see that economics isn't just some separate subject, but an essential tool for us as future engineers.

ReplyDeleteMicro and macroeconomics are explained clearly enough. The bullet points for each topic make it easy to understand what each branch covers. It's a good overview without getting too bogged down in jargon

ReplyDeleteThe 'Time Value of Money' section with the numerical examples was super helpful. Actually working through those future value and present value problems made the concepts much clearer than just reading about them.

ReplyDelete